|

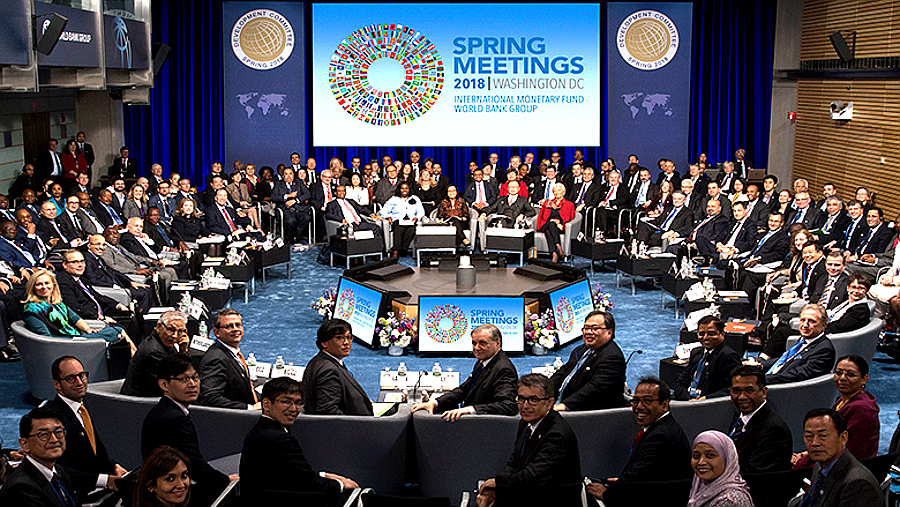

The IMF and World Bank meet in troubled times Simmering risks Gourinchas feels that ‘four simmering downside risks are especially worrying.’ He notes that today’s ‘surging investment in artificial intelligence echoes the dot-com boom of the late 1990s.’ In this precarious situation, markets ‘could reprice sharply, especially if AI fails to justify lofty profit expectations. That would dent wealth and curb consumption, with adverse effects potentially reverberating through the financial system.’ Secondly, the ‘outlook remains worrisome in China, where the property sector is still on shaky footing four years after its property bubble burst.’ For the present, manufacturing ‘exports have buoyed growth, but it is hard to see how this could last.’ Obviously, a serious economic malaise within the Chinese economy would have major global implications. The post also takes stock of the ‘fiscal strains’ being experienced, even by ‘some major advanced economies.’ Gourinchas warns that without ‘immediate action, slower economic growth, higher real interest rates, coupled with elevated debt and new spending needs—for defense, economic security, climate—will further tighten the fiscal vise.’ Ominously, he suggests that many ‘poorer countries remain scarred by the shocks of the last five years. Limited opportunities could fuel social unrest, particularly among unemployed youth.’ Finally, repeating a theme that is dear to the heart of the IMF, Gourinchas worries that ‘central bank independence’ might be in danger. He asserts that for ‘central banks, pressures to ease monetary policy, whether to support the economy at the expense of price stability, or to lower debt servicing costs, always backfire.’ He includes a graph to drive home his message that a free hand for central bankers ‘is key for preserving economic and financial stability.’ Though it is, of course, left unstated, the entire thrust of the IMF’s arguments run counter to the directions being taken by the Trump administration. The initiatives being pursued under the influence of the America First turn are a complete rejection of the ‘pragmatic and adaptive multilateral system that fosters cooperation can help us meet these challenges’ that Gourinchas champions. For her part, the IMF’s managing director, Kristalina Georgieva, took pains to stress the volatility and uncertainty of the present situation in her public remarks prior to the meetings. As the Guardian reports, she ‘issued a stark warning about the mounting risks facing the global economy, saying: “Buckle up: uncertainty is the new normal”.’ Yet, the political reality is that this very uncertainty is being compounded at every turn. Indeed, even as the Bretton Woods institutions gather in Washington, trade tensions with China have been reignited. As Al Jazeera reports, on ‘October 9, China expanded export controls to cover 12 out of 17 rare-earth metals and certain refining equipment, effective December 1, after accusing Washington of harming China’s interests and undermining “the atmosphere of bilateral economic and trade talks”.’ The Chinese government’s measures ‘were in response to the US restrictions on its entities and targeting of Beijing’s maritime, logistics and shipbuilding industries.’ Trump, however, ‘threatened to impose an additional 100 percent tariff on Chinese goods. It is entirely possible that this escalation in trade hostilities will be resolved in the short term, but to say the least, Trump isn’t listening to the IMF’s advice and the uncertainty that Georgieva speaks of is intensifying with every passing month. Diminished role Writing for GIS, no lesser commentator than Prince Michael of Liechtenstein draws some apt conclusions with regard to the diminished role of the IMF and the World Bank. He argues that this ‘year, however, that spirit of multilateralism may be sidelined. Being held in Washington, the meetings will likely become an opportunity for one-on-one negotiations with the U.S. government on tariffs rather than coordinated global dialogue.’ He adds that this ‘strategy might work in the short term, but it merely postpones the inevitable.’ The Bretton Woods institutions were both advisers and enforcers under a world order that is being laid to rest. Writing for Counterfire in February, John Rees argued that we ‘are entering a new historic era. We are leaving behind the era of globalisation and what the liberal political centre like to think of as the “rules-based international order”.’ Rees went on to speak of ‘an emerging multipolar world, a world in which America remains the most powerful state but no longer seeks to control the world order unilaterally as it did in the post-Cold War period.’ Moreover, ‘these are world-historic shifts in the structure of international relations, the consequences of which will unfold over many years if not decades.’ In this context, it is hardly surprising if the organisations that emerged after Bretton Woods are largely rudderless. At this stage, there is no consensus or even coherent proposal for any alternative to the system of international relations that a still dominant but declining US has jettisoned. At this stage, side deals with Washington and efforts to appease Trump are the focus and the annual gatherings of the IMF and World Bank, while they will go through the motions and keep up pretences, are of greatly reduced relevance. In his Prison Notebooks, Antonio Gramsci famously asserted that the ‘crisis consists precisely in the fact that the old is dying and the new cannot be born; in this interregnum a great variety of morbid symptoms appear.’ Donald Trump certainly qualifies as a morbid symptom, but his whole America First approach is by no means reducible to his detestable personal qualities or his propensity for erratic behaviour. He expresses historic changes within global capitalism and the place of the dominant economic and military power within it. Just as surely, when the IMF and World Bank gather for their annual showcase meetings, the undermining of both their prestige and relevance is a product of these massive global changes and a morbid symptom in its own right. This week, the Bretton Woods institutions will assess the world’s economic problems and the political considerations that impact them. They will issue carefully crafted advice and propose policy directions to meet these challenges. The problem is, however, that Trump and his senior functionaries view the IMF and World Bank with contempt, as relics of an order they have rejected. The bitter truth is that the fictional ‘multilateral system that fosters cooperation’ that the IMF’s director of research values so greatly has been thrown on the scrap heap. https://www.counterfire.org/article/the-imf-and-world-bank-meet-in-troubled-times/ Back |

|

||||||

|

|||||||